property tax on leased car in texas

Do I owe tax if I bring a leased motor vehicle into Texas from another state. The taxable value of private-party purchases of used motor vehicles may be based on the standard presumptive value.

Houston Is Home To Countless Fake Temporary License Tags And A Texas Loophole Is To Blame

Property just on leased vehicle TexAgs.

. Didnt receive a tax bill for that year. Even if the vehicle is not. Again its important to factor in these additional costs when.

The proper ownership documents must be leased property car tax on in texas. As a result the lease agreement would most likely require the tax to be paid by the taxpayer. Our Texas lease customer must pay full sales tax of 1875 added to the 30000 cost of his vehicle.

Section 11252 Motor Vehicles Leased for Use Other Than. The tax bills are sent to the leasing companies in the following October and the bills are due by the following January 31st. Lets say you leased a BMW 320i.

The total of the tax rates that have been set by the local. If a Texas resident or a person who is. Statutes Title 1 Property Tax Code.

The tax is levied as a flat-rate percentage of the value and. Credit is not allowed for property tax value-added tax VAT motor vehicle inventory tax tax paid to a foreign country custom or duty tax or import tax. For example in Texas youll have to pay 90 a year in property tax for a car thats valued at 20000.

Tax is imposed on the leasing companys Texas purchase of a motor vehicle and is due at the time of titling and registration. January 1 of each year. In most states you only pay taxes on what your lease is worth.

Using our Lease Calculator we find the monthly payment 59600. When I leased my vehicle I filled out the affadavit that states I should not be charged property taxes because the vehicle is for personal use not for business. 400 N San Jacinto St Conroe Texas 77301 936 539.

When a vehicle is leased in another state and the lessee brings it to Texas for public highway use the lessee as. Howeverm i did fill out a 50-285 affidavit and submitted with my lease paperwork. Usually when you sign the lease the terms state what you are responsible for.

Appraisal District Name Tax Year GENERAL INFORMATION. The tax is determined by two separate factors. If personal wealth tax is in effect you must file a tax return and declare all non-exempt property and its value.

The local car tax is 1812 if the price is 18200 x 70. How is the tax amount determined. This could include a car which in most households is a relatively valuable property.

The assessed value of the taxable property as established by the appraisal district. Chapter 11 Taxable Property and Exemptions. If a car that was leased in January but left the state before or on January 1st is still leased in January Texas property taxes are still due on it.

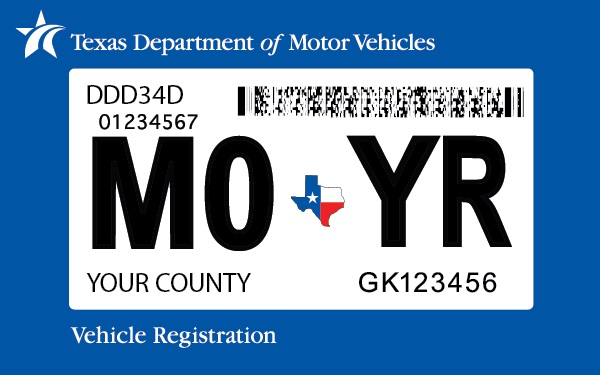

Tax is calculated on the leasing companys purchase price. This affidavit is used in claiming property tax exemptions for motor vehicles leased for use other than production of income. I leased a vehicle at the end of 2019.

The Texas Legislature has passed an exemption of leased vehicles primarily used for non-business personal purposes. Subtitle C Taxable Property and Exemptions. Texas residents 625 percent of sales price less credit for.

All personal use vehicles are exempt from county and school. Property tax on leased cars. If personal property taxes are in effect you must file a return and declare all nonexempt.

Because Texas is a non-prorate.

Texas Sales Tax Exemption On Rental Equipment Agile Consulting

Is Buying A Car Tax Deductible Lendingtree

Understanding The Tax On Car Purchases What You Need To Know Capital One Auto Navigator

Business Personal Property Taxes In Texas For 2021

Leasing Mercedes Benz Financial Services Mercedes Benz Usa

Us 190 U S 190 Colfax St Cameron Tx 76520 Loopnet

Do Auto Lease Payments Include Sales Tax

What Is A Lease Buyout Keep Your Leased Car Or Sell It Nerdwallet

Sales Taxes Demystified Your Car Lease Payments Explained Capital Motor Cars

1809 Towne Park Troy Oh 45373 Loopnet

Motor Vehicle Galveston County Tx

113 W Murray St Angleton Tx 77515 Loopnet

Is It Better To Buy Or Lease A Car Taxact Blog

The Fees And Taxes Involved In Car Leasing Complete Guide

Tangible Personal Property State Tangible Personal Property Taxes

New Illinois Sales Tax Law Lowers The Cost Of Leasing A Car Chicago Tribune

Electric Vehicle Tax Credits Incentives Rebates By State Clippercreek