cumulative preferred stock dividends in arrears

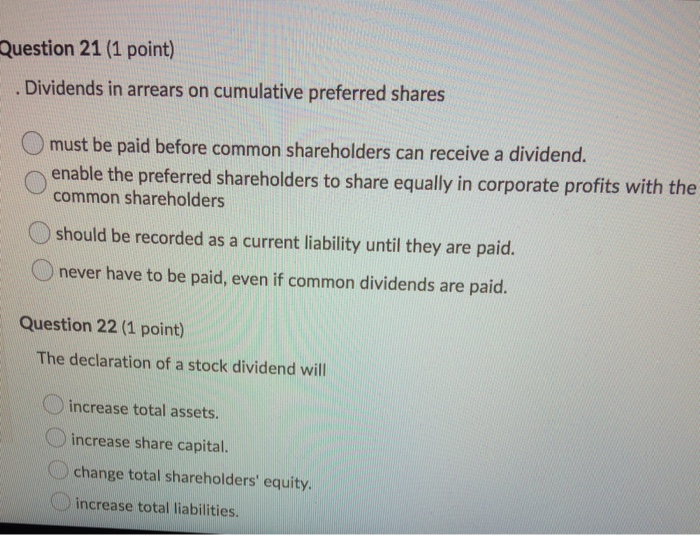

Disclosure of dividends in arrears on cumulative preferred stock. Dividends in arrears on cumulative preferred shares.

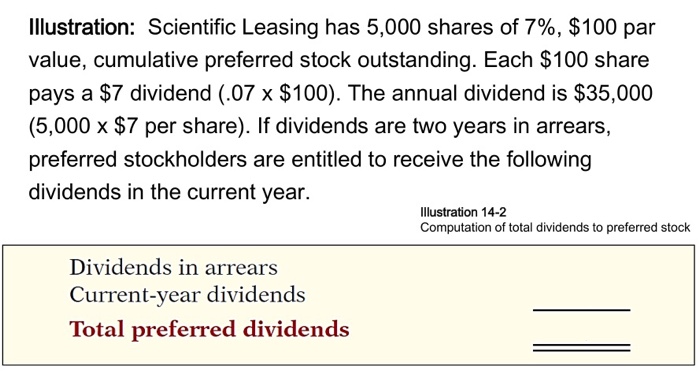

Solved Illustration Scientific Leasing Has 5 000 Shares Of Chegg Com

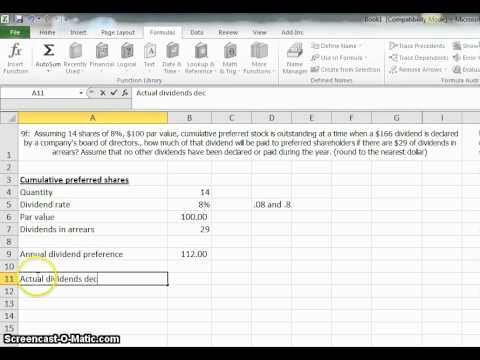

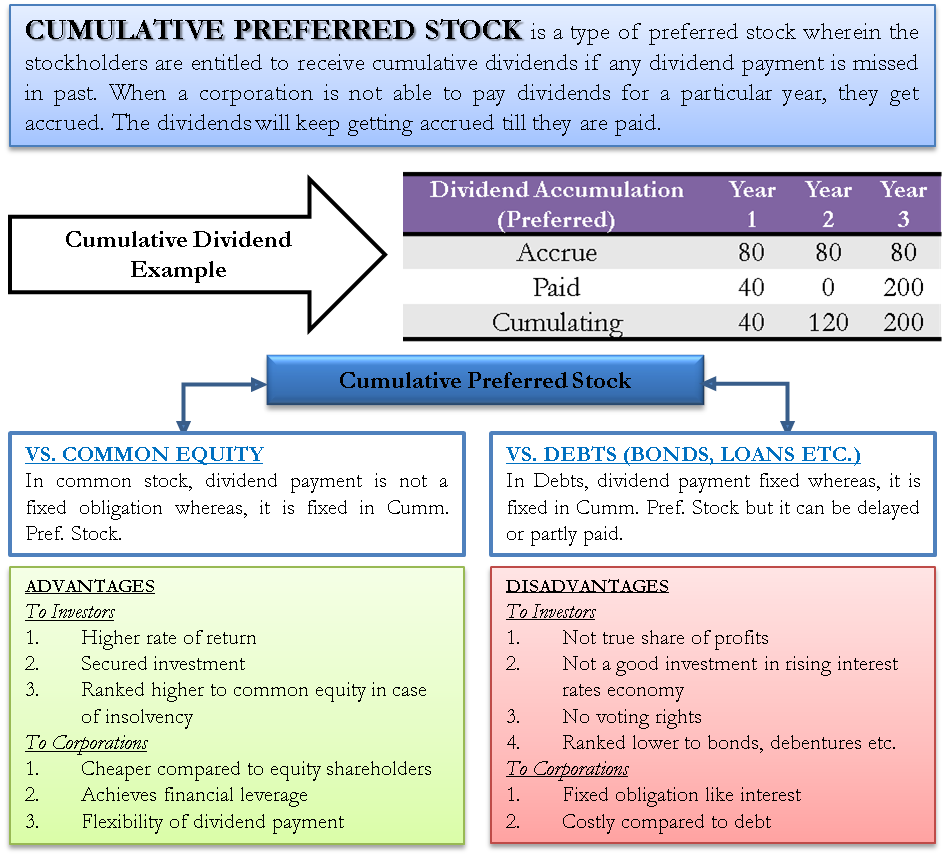

Dividends in arrears are dividend payments that have not yet been paid on cumulative preferred stock also known as preference shares.

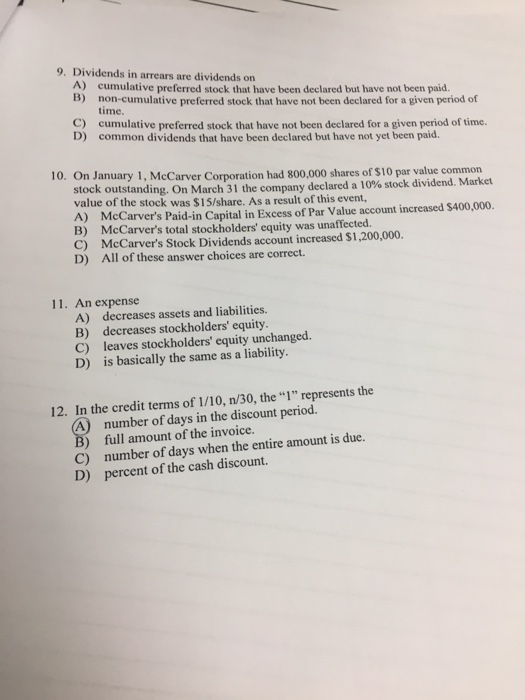

. The dividends will be paid as follows. Dividends in arrears are dividends on. In this case cumulative refers to the fact that these dividends will accumulate until payment.

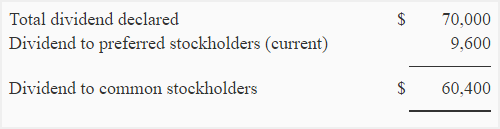

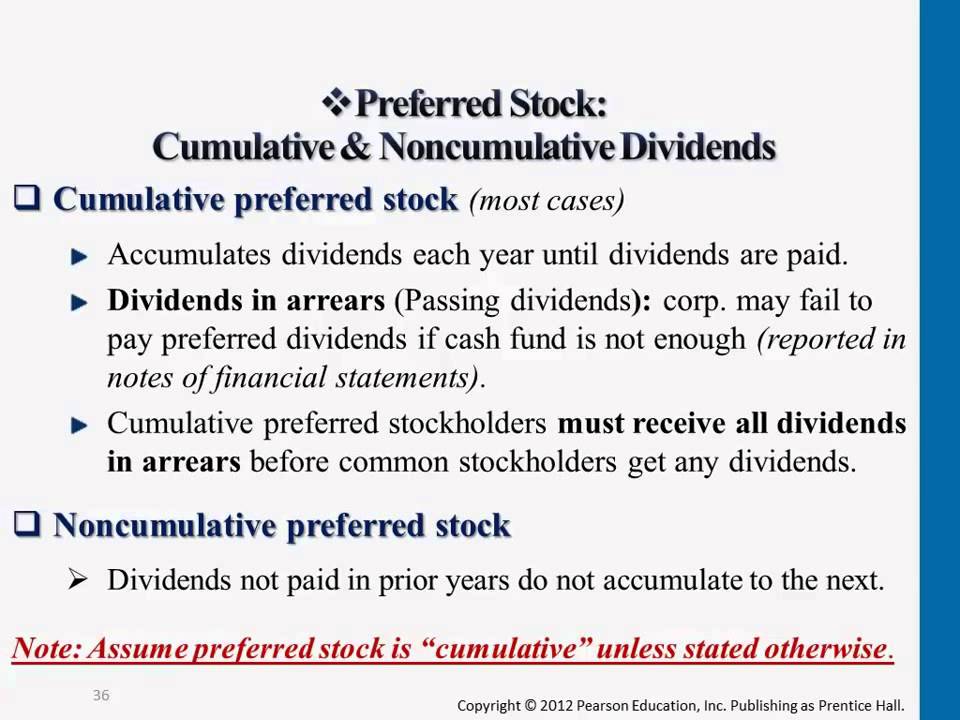

Preferred stock can be cumulative or noncumulative. Pay 30000 to preferred stockholders for the dividends in arrears. Should be disclosed in the notes to the financial.

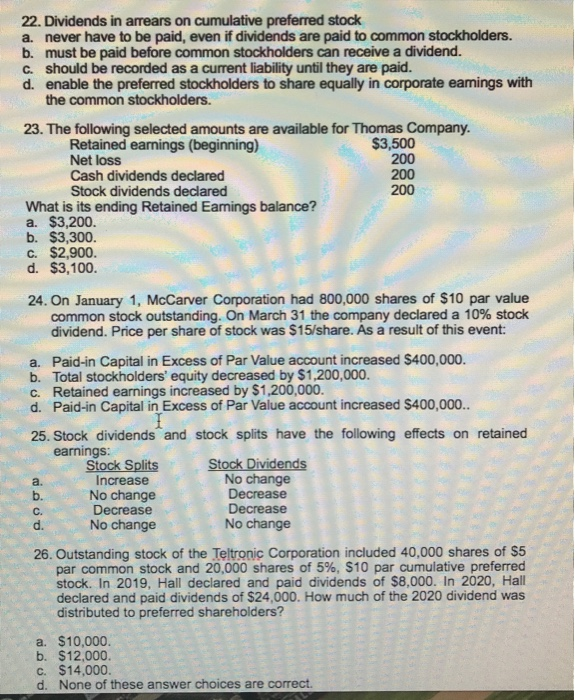

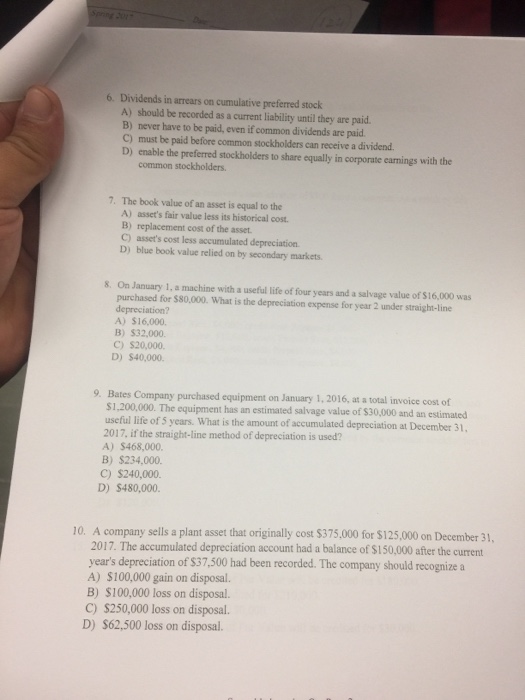

Dividends in arrears cumulative preferred shares A. B never have to be paid even if common dividends are paid. A stock without this feature is known as a noncumulative or straight preferred stock.

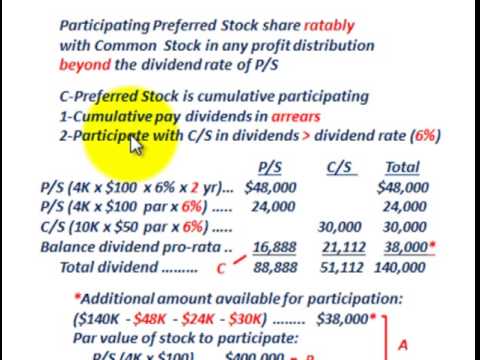

However due to some errors in production the company made a loss. Considered to be. By implication the company will pay a 100000 dividend every year that is 10100 x 1000000.

She is devising a plan to compensate the preferred stockholders for 80 percent of the. Ad Search Ex-Dividend Dates Dividend Calendar All-Star Rankings More. Any time a company doesnt declare preferred dividends for shareholders of cumulative preferred stock the dividends are counted and recorded as in arrears for receiving possible future payments.

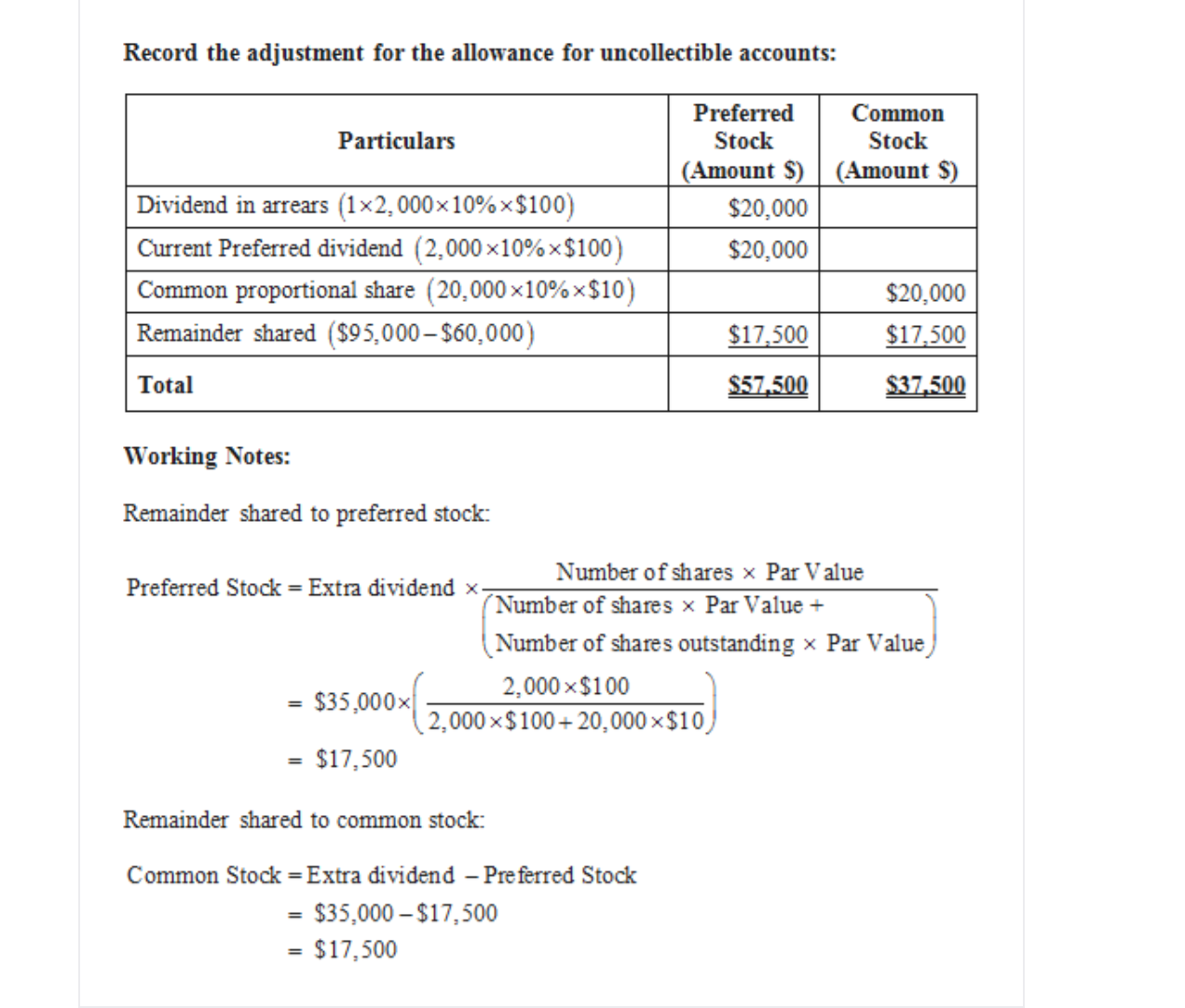

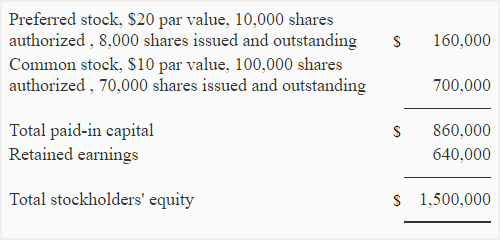

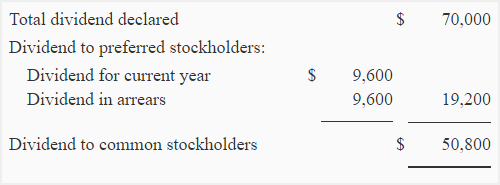

Now lets assume that the corporation decides to pay dividends of 25000 instead of 60000. It also has ordinary shares worth 5 million. New Look At Your Financial Strategy.

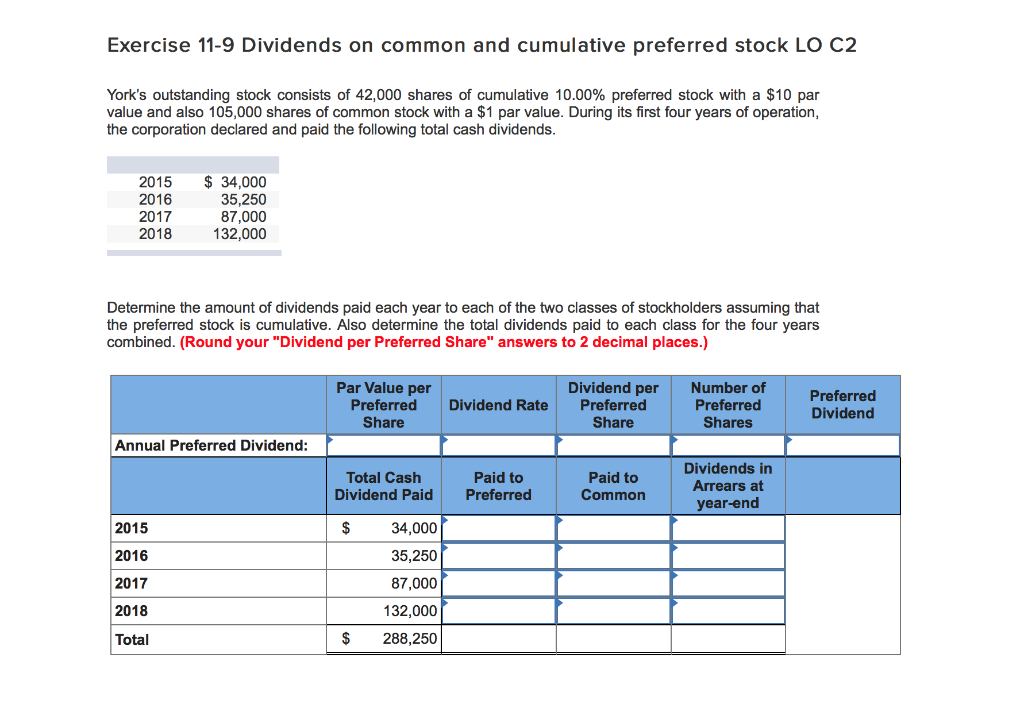

20Y1 56300 30000 20Y3 112500 Determine the dividends per share for preferred and common stock for each year Round all answers to two decimal places. Suppose a company. The following amounts were distributed as dividends.

Any unpaid dividend on preferred stock for an year is known as dividends in arrears. Are considered to be a non-current liability. ABC has a 10 cumulative preferred stock at 1 each valued at 1 million in 2019.

Continuing the example multiply 10 by 100000 to get 1 million in total dividends in arrears. The entire 25000 must be paid to the. Cumulative preferred stock is a type of preference share that has a provision that mandates a company must pay all dividends including those that were missed.

Find Todays Best Dividend Stocks Ex-dividend Dates and Stock Data. What exactly is this telling us. Pay 20000 to the common stockholders.

All passed dividends on a cumulative stock make up a dividend in arrears. C must be paid before common stockholders can receive a dividend. Only occur when preferred dividends have been declared.

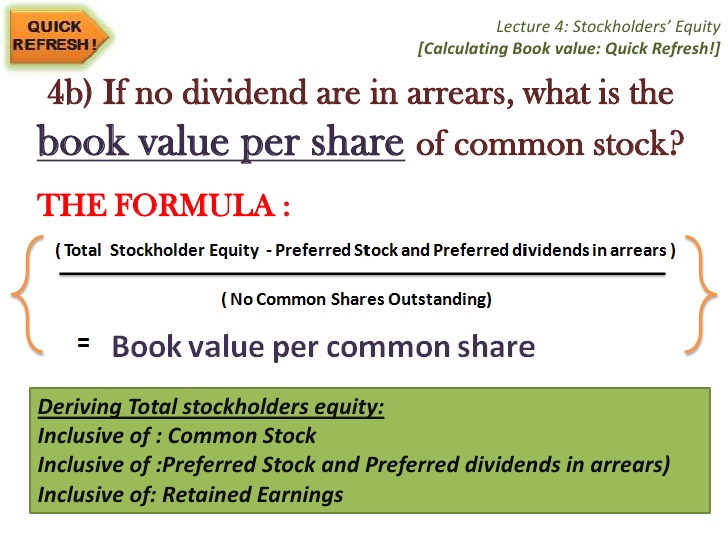

Common shareholders equity Total shareholders equity A-L - Preferred stock outstanding - Cumulative preferred dividends in arrears. Cumulative preferred stock is a type of preferred stock with a provision that stipulates that if any dividend payments have been missed in the past the dividends owed must be paid out to. Dividends in arrears may pile up over several subsequent payment.

Dividends in arrears on cumulative preferred stock A should be recorded as a current liability until they are paid. Visit The Official Edward Jones Site. These dividends have not been authorized by the board of directors because the issuing entity does not have sufficient cash to make the payment.

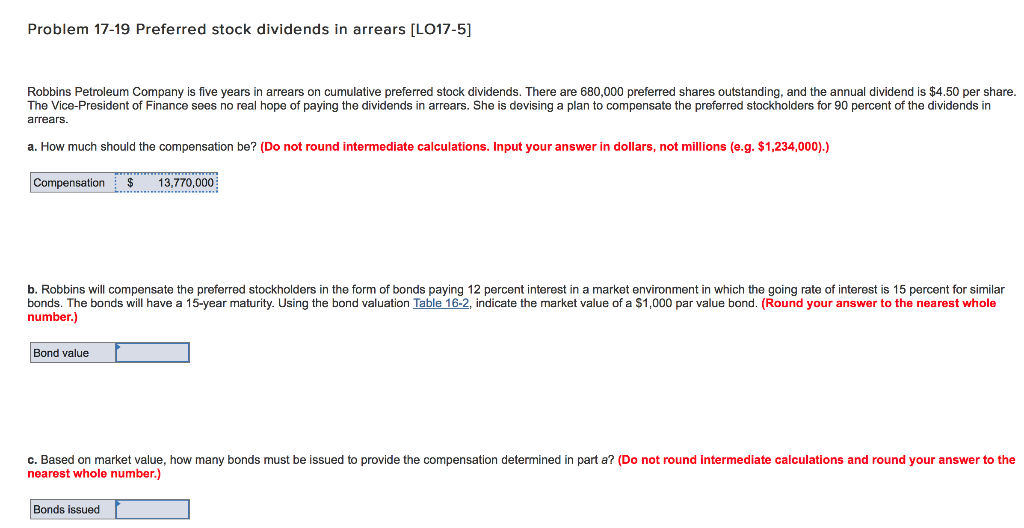

There are 690000 preferred shares outstanding and the annual dividend is 650 per shareThe vice president of finance sees no real hope of paying the dividends in arrears. Robbins Petroleum Company is four years in arrears on cumulative preferred stock dividends. Learn ways dividends can help generate income in this free retirement investment guide.

Do Your Investments Align with Your Goals. Multiply the dividends in arrears per share by the cumulative preferred shares outstanding to calculate the total dividends in arrears. It successfully paid up dividends for 2019 and 2020.

Are considered to be a current liability. Cumulative preferred stock that have not been declared for a given period of time. Dividends Per Share Sandpiper Company has 25030 shares of cumulative preferred 1 stock 130 par and 50000 shares of 23 par common stock.

Download The Definitive Guide to Retirement Income. Find a Dedicated Financial Advisor Now. When a dividend is not paid in time it has passed.

Dividends in Arrears. And the amount is typically based on the. Dividends are ordinarily paid to preference shares quarterly or annually.

But I dont understand why we subtract preferred stock outstanding. Pay the preferred stocks current year dividend of 10000. Any dividends passed are lost if not declared.

If the prospectus says the preferred stock is non-cumulative there will be no dividends in arrears. The disclosure of dividends in arrears is an important financial indicator for investors and other users of financial statements. Generally preferred stock will trade with a higher yield than the same companys bonds to make.

A preference share is said to be cumulative when the arrears of dividend are cumulative and such arrears are paid before paying any dividend to equity shareholders. This means the company must pay 1 million to cumulative preferred stockholders when it declares a new dividend. A dividend in arrears is a dividend payment associated with cumulative preferred stock that has not been paid by the expected date.

View the full answer. Dividends in arrears are the amount of previously unpaid dividends accumulated under the cumulative preferred stock. Such disclosure is made in the form of a balance sheet note.

Ad Have a 500000 portfolio. D enable the preferred stockholders to share equally in corporate earnings with the common stockholders. Common dividends that have been declared but have not yet been paid.

Non-cumulative preferred stock that have not been declared. If that definition is true I dont understand how the 2 numbers differwhat theyre asking.

Answered A Corporation S Shareholders Are Not Bartleby

Compute Preferred Dividend On Cumulative Preferred Stock With Dividends In Arrears Youtube

Cumulative And Noncumulative Preferred Stock Explanation And Example Accounting For Management

How Are Dividends Paid When There Are Dividends In Arrears Accounting Services

Cumulative Preferred Stock Define Example Benefits Disadvantages

Preferred Stock Cumulative Fully Participating Allocating Dividends Between P S C S Youtube

Cumulative And Noncumulative Preferred Stock Explanation And Example Accounting For Management

Solved 22 Dividends In Arrears On Cumulative Preferred Chegg Com

Solved Problem 17 19 Preferred Stock Dividends In Arrears Chegg Com

Solved 9 Dividends In Arrears Are Dividends On A Chegg Com

Solved Question 21 1 Point Dividends In Arrears On Chegg Com

Cumulative And Noncumulative Preferred Stock Explanation And Example Accounting For Management

Dheeraj On Twitter Dividends In Arrears In Cumulative Preferred Stocks Definition Https T Co U8m0grh9hc Dividendsinarrears Https T Co 8wwb2ppsys Twitter

Preferred Stock Cumulative Noncumulative Dividends Youtube

Solved Exercise 11 9 Dividends On Common And Cumulative Chegg Com

Preferred Stock Cumulative Vs Noncumulative Participating Vs Nonparticipating Dividends Youtube

Solved Dividends In Arrears On Cumulative Preferred Stock Chegg Com

Preferred Stock Cumulative Vs Noncumulative Participating Vs Nonparticipating Dividends Youtube